Never give your social security number over the phone. Think twice before you wire money. Be sure to look over credit card and bank statements carefully. Shred, shred, shred.

Keeping pace with the number of ways to prevent being tricked out of our hard-earned money is challenging because new types of fraud are being developed every day. Older adults, especially those who are isolated, can be easy targets.

Keeping pace with the number of ways to prevent being tricked out of our hard-earned money is challenging because new types of fraud are being developed every day. Older adults, especially those who are isolated, can be easy targets.

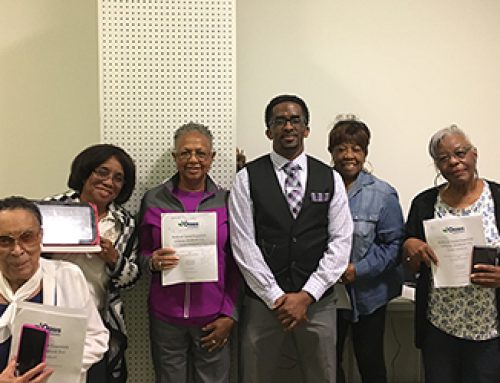

“We’ve all had one kind of experience or another, an attempt at fraud that we recognized for what it was. This is certainly a subject that needs publicity,” says retired economics professor Dick Waits. Dick is among a group of Oasis volunteers who served as facilitators in Fraud Fighters, a pilot project supported by Wells Fargo Advisors.

Fraud Fighters empowers adults 50 plus to help one another stop scammers in their tracks. With a curriculum based on materials developed by the Federal Trade Commission, Wells Fargo Advisors’ “Hands On Banking” and other expert sources, the project reached over 500 people directly in San Antonio and St. Louis, with information to share with friends and loved ones.

Fraud Fighters facilitators were trained to provide information about common types of fraud, such as identity theft, paying too much, healthcare scams, imposter “granny scams, ”You’ve won!” scams and tax fraud.

Facilitators and participants were encouraged to share what they know and learned with their family, friends and neighbors. More than 83 percent indicated that they planned to do so. Ninety percent rated their ability to identify fraud as “improved or greatly improved” as a result of the class. Over half of participants said they planned to make changes to the way they handle their own finances.

“Elder fraud is a priority for our center,” said Brenda Schmachtenberger, executive director of San Antonio Oasis. “As we are talking to seniors in the community, we know that they are being targeted. It is important that they are aware of the new scams that are being developed.

“Elder financial abuse is a crime that is estimated to cost victims in excess of $3 billion each year,” said Ronald C. Long, Director of Regulatory Affairs and Elder Client Initiatives at Wells Fargo Advisors, LLC. “Partnering with Oasis has been a great way to educate older adults about how to protect themselves and others from fraud.”

“Elder financial abuse is a crime that is estimated to cost victims in excess of $3 billion each year,” said Ronald C. Long, Director of Regulatory Affairs and Elder Client Initiatives at Wells Fargo Advisors, LLC. “Partnering with Oasis has been a great way to educate older adults about how to protect themselves and others from fraud.”

Leave A Comment